lv smoothed managed funds LV= Smoothed Managed Funds. Your guide to how we manage our unitised with . In a nutshell, the guide is a giant spreadsheet with all of the data you need to level up all 8 crafting jobs from 1-80. It fully covers both crafting leves and Ishgardian Restoration collectables and has super detailed data tables that contain everything you need to know:

0 · lv smoothed managed funds bond

1 · lv smoothed managed balanced

2 · lv smoothed fund performance

3 · lv flexible transitions account charges

4 · lv flexible transitions account

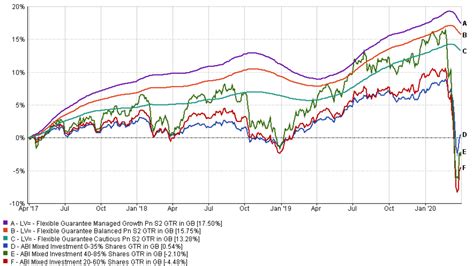

5 · lv flexible guarantee managed growth

6 · lv flexible guarantee cautious s2

7 · lv fgf balanced s2 fund

250 Star Velvet Aimimg Set: Crafted. 60 250 Prototype Alexandrian Aiming Set: Obtained by trading in the various tokens obtained from Alexander: The Creator to Sabina: 60 260 Shire Aiming Set: Obtained in exchange for Allagan Tomestone of Scripture: 60 270 Alexandrian Aiming Set

Our Smoothed Pension supports investors of different ages, whether you're saving for your retirement, or accessing your pension to draw income. You can use the funds flexibly as a standalone investment, or as a safer investment option within a bigger portfolio.Guarantee - Annual Terms and Charges A guarantee is bought at an extra monthly .

LV= Smoothed Managed Cautious Fund This fund option is designed to provide .

gucci bird ring

LV= Smoothed Managed Funds. Your guide to how we manage our unitised with .The LV= Smoothed Managed Funds incorporate a unique averaging .Our Smoothed Managed Funds are multi-asset and risk-rated to specifically appeal to clients with a ‘very low’ to ‘medium’ attitude to investment risk. They are managed to our exacting mandate in partnership with BlackRock, one of the .LV= Smoothed Managed Cautious Fund This fund option is designed to provide long-term steady growth together with a low level of investment risk. The fund invests, either directly or .

The latest fund information for LV= Smoothed Managed Growth Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.

lv smoothed managed funds bond

LV=’s Smoothed Managed Funds have an in-built smoothing mechanism – uniquely designed to reduce the impact of daily market volatility. Learn more about its benefits and how it works. For UK Financial Advisers only.Our LV= Smoothed Managed Funds Pension Series 1 (Smoothed Pension) offers a range of multi-asset funds designed for steady growth with a smoother investment journey, reducing the stress and anxiety that can come with stock .

The LV= Smoothed Managed Funds incorporate a unique averaging mechanism called 'smoothing' which is designed to smooth out the impact of short-term market movements. How .LV=’s Smoothed Managed Funds are expertly managed and responsibly invested. Learn more about what fund management and responsible investing means to us. For UK Financial advisers only.

LV= Smoothed Managed Funds. Your guide to how we manage our unitised with-profits Smoothed Managed Funds business. Contents. 1 Introduction. 2 Background on LVFS. 3 .

This fund is designed to provide long term moderate growth together with a low to medium level of investment risk. The fund invests, either directly or indirectly, in a diversified .Optional capital guarantee available - lock-in fund value for a fixed 10-year term, helping reduce downside risk. 10-year guarantee periods only available with Smoothed Managed Cautious fund. The Smoothed Bond can list up to two lives assured (maximum age: 89), although neither of these can be the Bond owner.

LV= Smoothed Managed Funds Pension S1 (LV= Smoothed Pension) Our Smoothed Pension aims for long term steady growth and helps manage the impact of volatility by averaging investment values over a rolling 26-week period. Fund management charges.

Our responsibility - Although we outsource the asset management behind the Smoothed Managed Funds, the responsibility for producing strong risk-adjusted investment returns for policyholders rests with LV=.; In-house expertise - Our .LV= Smoothed Managed Funds Bond Series 1 (Smoothed Bond) unit prices. See the latest daily prices for the range of fund options. Averaged Prices for the following funds as at 31/10/2024. Investment Fund Unit Price; Smoothed Managed Extra Cautious: 103.82p: Smoothed Managed Cautious: 99.55p: Smoothed Managed Balanced:The latest fund information for LV= Smoothed Managed Balanced Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.

View the latest Smoothed Managed Funds charges guide LV= Smoothed Bond guarantee charges – for bonds starting from June 2021 If your client already has an LV= Smoothed Bond, the charge for this is shown on their Bond Summary or Guarantee Endorsement and .Smoothed Managed Funds Bond Series 1 - Smoothed Managed Growth Fund ISIN code: GB00BNVVFH41 Liverpool Victoria Financial Services Limited, www.LV.com. Call 0800 5877857 for more information. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation

pour homme ysl

This fund is designed to provide long term higher growth together with a medium level of investment risk. The fund invests, either directly or indirectly, in a diversified portfolio of fixed interest securities, equity, prope rty, cash and other related instruments. The fund aims to avoid sharp rises and falls by gradually averaging the price applied to the investment over the first .The latest fund information for LV= Smoothed Managed Growth Bond, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.The latest fund information for LV= Smoothed Managed Cautious Bond, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.LV= Smoothed Managed Funds. LV= Smoothed Managed Funds Investment Report 2023 (PDF, 929KB) LV= Smoothed Managed Funds Extra Cautious TCFD Product Report 2023. LV= Smoothed Managed Funds Cautious TCFD Product Report 2023. LV= Smoothed Managed Funds Balanced TCFD Product Report 2023.

Funds - Annual Management Charge. The Annual Management Charge (AMC) is 0.80% of the funds' value across all of our fund options. The charge is taken monthly as 1/12 of the annual charge by cancelling units. Read more about the LV= Smoothed Managed Pension fund optionsLV= Smoothed Managed TIP Balanced Fund. This fund option is designed to provide long-term moderate growth together with a low to medium level of investment risk. The fund invests, either directly or indirectly, in a diversified portfolio of fixed interest securities, equities, property, cash and other related instruments.* .

lv smoothed managed balanced

lv smoothed fund performance

The latest fund information for LV= Smoothed Managed Growth Plus Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.The latest fund information for LV= Smoothed Managed TIP Growth Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.The LV= TIP is a plan which invests in our Smoothed Managed Funds.It allows you access to our unique funds as part of your investment strategy in Self-invested Personal Pensions (SIPP) or Small Self-administered Schemes (SSAS).Smoothed Managed Growth Plus This fund option is designed to provide the long term steady and sustainable growth together with a medium level of investment risk. Within this objective we aim to invest in more sustainable .

goyard world fake

The latest fund information for LV= Smoothed Managed Cautious Pn, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.Your guide to how we manage our unitised with-profits LV= ISA 3 Smoothed Managed Funds Your guide to how we manage our unitised with-profits LV= ISA 1 Introduction This guide explains how we look after our with-profits business. If you have the following product this guide applies to you: y LV = ISA (including plans originally sold on a non . This fund is designed to provide long term moderate growth together with a low to medium level of investment risk. The fund invests, either directly or indirectly, in a diversified portfolio of fixed interest securities, equi ties, property, cash and other related instruments. The fund aims to avoid sharp rises and falls by gradually averaging the price applied to the .

The latest fund information for LV= Smoothed Managed Balanced Bond, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund manager information.Smoothed Managed Funds. Overview. Smoothed Managed Funds; Smoothing explained; Fund management; Risk ratings; More. Quote & apply; Servicing; With-Profits; LV= Platform Services. . View daily fund pricing and historical performance of the LV= Core Fund range. Access free Fund X-Ray reports and Fund Fact Sheets. Rank and compare all funds in . LV= Smoothed Managed Cautious Pn + Add to watchlist + Add to portfolio. GB00BNRK2X02:GBP. LV= Smoothed Managed Cautious Pn. Actions. Add to watchlist; Add to portfolio; Price (GBP) 1.00; . The chart shows how frequently the fund's 3M return is positive or negative. Each bar is an observation period (the fund's return over the past 3M, at .LV= Smoothed Managed Funds are designed to help deliver low-volatility returns for risk-sensitive clients. They are most suitable for cautious investors with a ‘low’ to ‘low-medium’ risk profile who are likely to be nearing, or in retirement.

The LV= Pension Portfolio and the LV= Junior Pension Portfolio give you the flexibility and choice to plan and save for your (or your child's) retirement. With access to our unique Smoothed Managed Funds, it can provide a smoothed journey and help cushion your investments from the ups and downs of the stock market. LV= Smoothed Managed Growth Plus Bond. Actions. Add to watchlist; Add to portfolio; Price (GBP) 1.12; Today's Change 0.00 / 0.00%; 1 Year change +11.19%; Data delayed at least 60 minutes, as of Oct 24 2024. . All managed funds data located on FT.com is subject to the FT Terms & Conditions.Lock-in fund value with the optional 10-year capital guarantee. Your clients can add to their investments at outset, or when a previous guarantee expires. 10-year guarantee periods only available with Smoothed Managed Cautious fund. Risk-rated funds. Our funds are risk-rated by multiple agencies. Simple on-boarding process. No signatures .

lv flexible transitions account charges

The following is a list of Arcanist's Grimoires from Final Fantasy XIV. Composed of a variety of books, they are used by primarily by Arcanists and Summoners. Scholars also have access to them at lower levels before branching off into their own exclusive Scholar's Arms. They do not allow the use.

lv smoothed managed funds|lv smoothed fund performance